At our bi-annual User Conference this year, Financial Risk Solutions (FRS), provided a comprehensive review of pensions in Australia, the United Kingdom and Ireland. This is an excerpt from this review. The full report is available for download here

The 2018 Global Pension Assets Study conducted by Willis Towers Watson reported Defined Contribution (DC) assets in funded pensions schemes now slightly exceed Defined Benefit (DB) assets across the largest 22 pension markets.

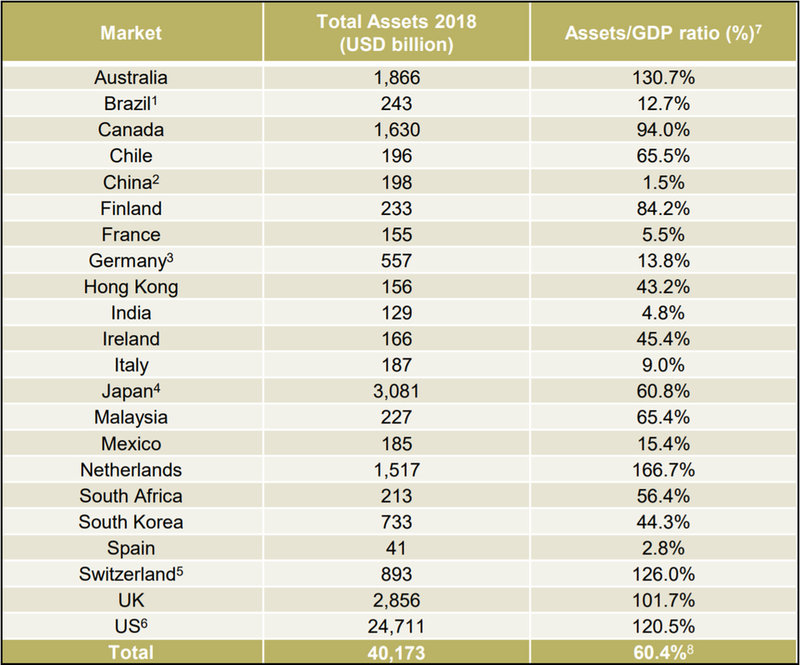

In this report, Financial Risk Solutions (FRS), explores the state of pensions in the three markets we are most active - Australia, United Kingdom and Ireland. Each is at quite different stages of their DC business with the ratio of pensions assets to Gross Domestic Product (GDP) ranging from 130 percent for Australia through to just 45 percent for Ireland.

Australia - a proven model for co-contributed pensions

There is no doubt that superannuation has been a considerable success for Australia since its inception in 1983. Superannuation assets in Australia represent EUR 1.667 trillion, which equates to nearly 78 percent of all managed funds in the country. The assets accumulated in the superannuation system, along with the removal of the pension burden from the government, is arguably one of the reasons Australia has not had a recession for nearly three decades.

The employer’s contribution rate has increased from three percent in 1992 to 9.5 percent today and is set to increase from 2021 by 0.5 percent per year up to 2025 when it will be 12 percent.

Room for improvement

Despite the positive picture of the Australian pension market, there are several industry-wide issues, including the large number of multiple accounts, some entrenched underperforming funds and the exclusion of people who earn less than AUD 450 a month.

An extensive Royal Commission review into banking and finance exposed some issues, including charging deceased people for life insurance and selling people products they didn’t need. With the regulators drafting new laws, we can expect some changes in this industry.’

THE United Kingdom - fast pensions growth through Auto Enrolment

While the UK came to co-contributed pensions much later than Australia, the uptake has been very impressive. Auto Enrolment (AE) for co-contributed pensions commenced in October 2012 in a staged approach. The scheme applies to employees from age 22 to state pension age with earnings above GBP 10,000 per annum and all employers are part of automatic enrolment by default.

Rapid growth

Today 84 percent of UK staff are in a workplace pension scheme, up from 77 percent last year. The total number of staff automatically enrolled by March 2018 was 9.5 million, up from 5.2 million in 2015 and the amount saved in 2017 was GBP 90.3 billion from GBP 86 the previous year.

However, changes in the way we work, such as the gig economy, impacts auto-enrolment and extending the scheme to freelancers or those on short-term contacts still poses a challenge to enable automatic enrollment for everyone.

Ireland - a world of possibility

Currently, auto-enrolment pensions do not exist in Ireland. Irish employers are obliged to make a pension plan available to employees, but neither employers nor employees are required to contribute to it.

Following the 2014 ‘Review of the Irish Pensions System,' the Irish Government intends to introduce an ‘Automatic Enrolment’ (AE) supplementary retirement savings system by 2022.

All employees earning over EUR 20,000 and between the ages of 23 and 60 who do not already have pension arrangements would be auto-enrolled into a defined contribution (DC) retirement savings scheme. The self-employed and those outside the above criteria would not be required to auto-enrol but could opt-in to the scheme.

Initially, employees will make contributions of one percent of earnings, increasing by one percentage point each year until year six when the contribution rate will fix at six percent. By 2027 the total targeted contribution would be 14 percent of eligible earnings.

Overseen by a Central Processing Agency

An independent Central Processing Agency will oversee the system and plan to select four ‘Registered Providers,’ that will be required to provide four different retirement saving fund options based on low to high-risk profiles, and a default fund.

Overall the proposal to introduce the AE system was welcomed by unions, employers and industry bodies. However, wide-ranging views on the government proposal may see AE delayed.

The Opportunity for Pensions Providers and Fund Administrators

Whatever their stage, DC pensions are only set to grow in these three markets over the coming years. Large increases in annual flows of new monies into funds provide an excellent opportunity for growth for pensions providers and fund administrators. It also presents a great responsibility to ensure robust systems, technologies and controls are in place to manage these funds efficiently and effectively while mitigating risk.

Download the full report here: “Pensions around the World: A deep dive into Defined Contribution Pensions in Australia, the United Kingdom and Ireland”

Frank Carr

Chief Marketing Officer

contact information

Financial Risk Solutions (FRS) Ltd

Email: frank.carr@frsltd.com

Web: www.frsltd.com