Natural disasters, such as earthquakes or floods, are obviously devastating to consumers. Jumpstart hopes to relieve some of the stress immediately after incidents such as these.

It’s a struggle to think of something that sounds as simple as Jumpstart’s coverage. You apply with the firm based on your location and if an intense quake affects your area, the customer receives a text. Once confirming expenses, the payment is directly deposited to the customer’s bank account. As the company, launched in October 2018, claims on its website: “No deductible, no paperwork, no hassle.”

Kate Stillwell, CEO, Jumpstart

Rebuilding efforts

Speaking to Verdict InsurTech, Jumpstart CEO Kate Stillwell (also the former president of Structural Engineers Association of Northern California) believes that this form of insurance can really make a difference where it counts.

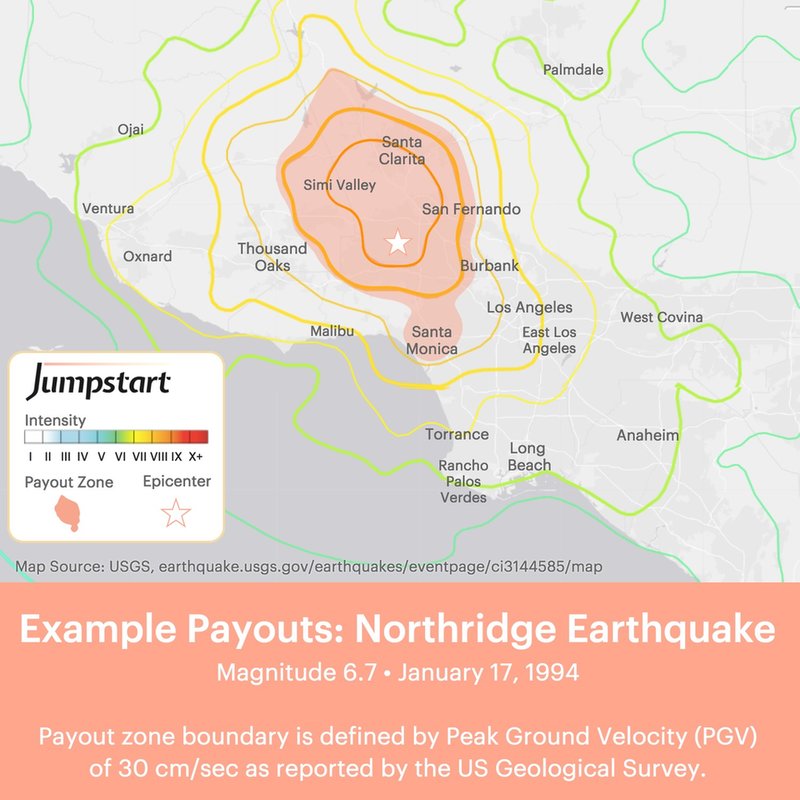

She says: “We're bringing parametric earthquake coverage to consumers, starting with earthquake risk in California. Parametric means that there is a specific event at which there is a specific payout provided. As opposed to indemnity insurance where you don't know how much money you're going to get, this reverses the psychology and takes away the uncertainty so customers know exactly how much money they get in which circumstances.”

“It has real exciting potential for risks like earthquakes where there's a big gap and people don't buy indemnity type products because there is so much uncertainty.”

A licensed structural engineer, Stillwell has experience of designing structures to withstand earthquakes. However, she realised that disaster resilience was about more than just buildings.

She explains: “I went into structural engineering, as most people do, to make the world a better place and a safe place, especially in the case of really big unexpected situations. I realised after Hurricane Katrina that these buildings are really important for communities to be able to recover, but it's not enough. What good are these buildings if the people don't stay in order to occupy them and build back and be part of the regrowth process?”

This meant more than rebuilding, but building back in the sense of investing in the community, rather than leaving.

“One of the things that make a difference in people staying or leaving is whether they have enough money,” Stillwell says.

The first of its kind?

There is an opportunity to fill the gap and an opportunity “to do well by doing good” if people can get enough money to make that difference. A huge part of this involves getting people the money as quickly as they need it. Why has this not been offered before?

Stillwell explains: “Parametric really bucks the trend of what insurance has been. It really is first-of-its-kind, but there was a barrier in terms of regulation. Working collaboratively with the regulator to make sure they respect that this is insurance, and not a derivative, particularly because insurance in the US is not taxable, so you don't have to pay tax on proceeds.

“Secondly, derivatives are only available to credited investors technically and not the general public. There's also the simple barrier of it's never been done before. Reassurance is needed. In order to make good on the promise on making the payment, the insurer has to believe there's a need for a completely different product category.

“A third more practical barrier is that for this to work, everything needs to be automated. The sign-up process, the policy administration, the claims administration, all of this has to be 100% automated. To do this, the technology has to be mature enough. It is mature enough now, but five years ago, it might not have been.”

Now and the future

Targeted towards those whom $10,000 really makes a difference, Jumpstart has received heavy interest in its early days.

While current customer numbers were not disclosed, in the first 48 hours after launch, 350 unique visitors obtained a quote. Furthermore, from this there was a double digit conversion rate.

Stillwell hopes to have 20,000 customers in the first twelve months and there are rooms to expand.

She concludes: “The lowest hanging fruit is earthquake in other states. We would love to get a Jumpstart product going in Washington and Oregon before too long. Another opportunity we're thinking about is flood because of the big gap in the number of people insured and there's such an opportunity to make a difference there.”