THOUGHT LEADERSHIP Sponsored by Financial Risk Solutions

Costs and charges for policyholders and members

IDD plus DC Independent Governance Committee reports, post-sale PRIIPs in another guise…

New regulations in the life and pensions industry will require considerable work by providers to remain compliant. Finding partners that can respond with regtech solutions to efficiently solve these problems is key for those providers subject to these new regulations.

Celebrating twenty years of delivering fund administration software to Life and Pensions companies in 2019, Financial Risk Solutions (FRS) prides itself on their domain expertise and advanced software that helps clients stay ahead of regulatory developments with minimal disruption to daily business.

Here we explore two important regulations, the Defined Contribution (DC) Workplace Pensions Regulation in the UK and the Insurance Distribution Directive (IDD) in Europe and how the Invest|ProTM platform is supporting clients by providing timely, cost effective enterprise solutions to these regulations.

Defined Contribution Workplace Pensions Regulation

The Defined Contribution (DC) Workplace Pensions Regulation in the UK is designed to protect the interests of consumers. This regulation requires reporting of a DC scheme’s costs and charges. The reports must be made to the trustees or Independent Governance Committee responsible for assessing the value for money received by members of workplace DC schemes.

The rules for calculations of these costs and charges are set out in the Financial Conduct Authority (FCA) Conduct of Business Sourcebook. Detailed in section 19.8 ‘‘Disclosure of transaction costs and administration charges in connection with workplace pension schemes,” these rules came into effect from January 2018.

These costs are the actual historic costs incurred, for example, over the last year and are required to be split out by the type of costs and charges. They need to include the direct costs and charges that are levied in your investment admin platform, the indirect costs for buying and selling the investments, and the indirect costs incurred for the underlying investments themselves.

The rules are reasonably detailed, especially for the transaction or slippage costs (the costs incurred as a result of the actual buying or selling of investments). They also state what kinds of costs and charges are not included, for example, the costs for providing insurance, mortality charges are not included.

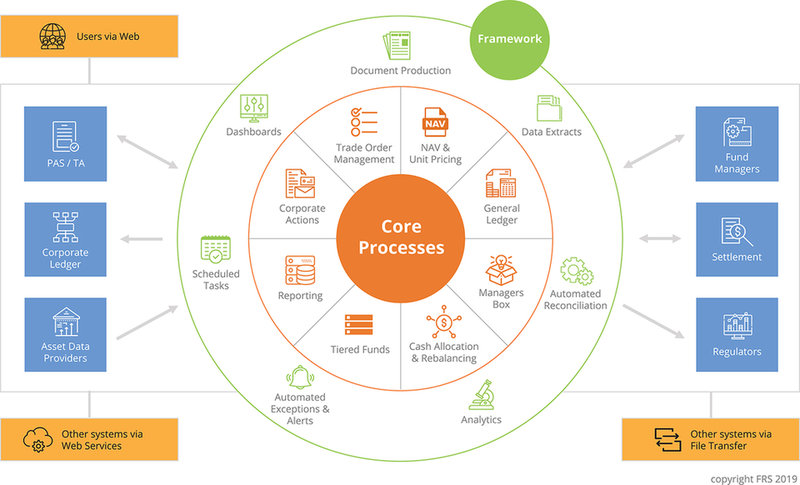

The Invest|ProTM platform provides the Optimum Operating Model for Life Companies. ©FRS 2019.

The Insurance Distribution Directive (IDD)

The second piece of legislation which covers similar ground is the Insurance Distribution Directive (IDD), an EU directive effective from October 2018, which introduces new requirements for firms distributing Insurance Based Investment Products (IBIP).

The definition of an IBIP is an insurance product that offers a maturity or surrender value that is exposed to market fluctuations, essentially all unit-linked products except pensions business.

One additional IDD requirement, new this year, is to provide a personalised post-sale periodic report of actual costs and charges over the last year for the individual product. This is as opposed to PRIIPs regulations which are pre-sale. The detailed requirements for this periodic report are not yet fully clear, but we would expect that the costs and charges that need to be calculated are similar to those for the UK Workplace Pensions Regulations and the MiFID II regulations. So, for a provider selling Individual Portfolio Bonds the actual costs and charges, both direct and indirect, incurred over the last year would need to be calculated. For unit-linked products, providers will have to first calculate the total costs and charges within each unit-linked fund and then allocate these costs proportionately to the individual policyholders in each fund. Non fund related charges will also have to be added.

“FRS believe that the logical place to capture additional data items required is the core investment administration system to maintain the integrity of a single target operating model.”

If the IDD regulations adopt similar methodologies to the UK Workplace Pensions or MiFID II methodologies, the costs and charges for a unit-linked fund investing in an external collective might include:

- Transaction Cost (slippage cost) of trading the underlying assets, the difference between the executed price and the mid-market (arrival) price

- The unit fund’s portion of the underlying collective’s Total Expense Ratio(s) (including the underlying collective’s transaction costs)

- The Charges (e.g. AMC) of the unit fund

- Fund Expense items should also be included

This requirement means that for each trade in an external asset the arrival or mid-market price is now required. FRS believe that the logical place to capture additional data items required is the core investment administration system to maintain the integrity of a single investment data set.

Calculating costs and charges in fund of fund structures

Trying to make these calculations on a spreadsheet can be quite difficult and comes with significant risks, particularly from a compliance perspective. For a fund of fund structure Invest|ProTM easily calculates the costs and charges over a time period for the higher-level funds, for example, the pension scheme and/or the funds into which a pension scheme, personal pension or insurance bond invests.

Invest|ProTM works out the amount of TER charge for Level 1 unit funds based on the external asset TER charge and the value of holding in that external asset each day. It also works out the transaction cost for the Level 1 charge based on the execution price and the mid-market price. These charges then go right up the fund of fund structure.

The Invest|ProTM platform provides the Optimum Operating Model for Life Companies. ©FRS 2019.

Finding the Optimum Operating Model

The specific workflow for the calculation of costs and charges under IDD or UK Workplace Pensions Regulations has two parts, firstly to load in the additional data required and then identify what expense types to include. The cost and charges calculations can then be calculated. The Invest|Pro™ output is detailed, providing data on each cost on each day and is automatically archived and date stamped.

In today’s world where various regulations are leading to increasingly individualised actual fund level calculations, Invest|Pro™ can do these calculations reducing operational risk and cost and meeting regulatory requirements, freeing up key resources to focus on business growth.

contact information

Financial Risk Solutions (FRS) Ltd

Email: frank.carr@frsltd.com

Web: www.frsltd.com